Evaluating Your Home for a Comfortable Retirement

Retirement is more than just a milestone; it's the beginning of a new chapter filled with opportunities to explore passions, spend time with loved ones, and enjoy the fruits of years of hard work. As you approach this exciting phase, it's essential to evaluate whether your current living situation aligns with the lifestyle and financial goals you envision for your retirement years.

Assessing Your Current Home

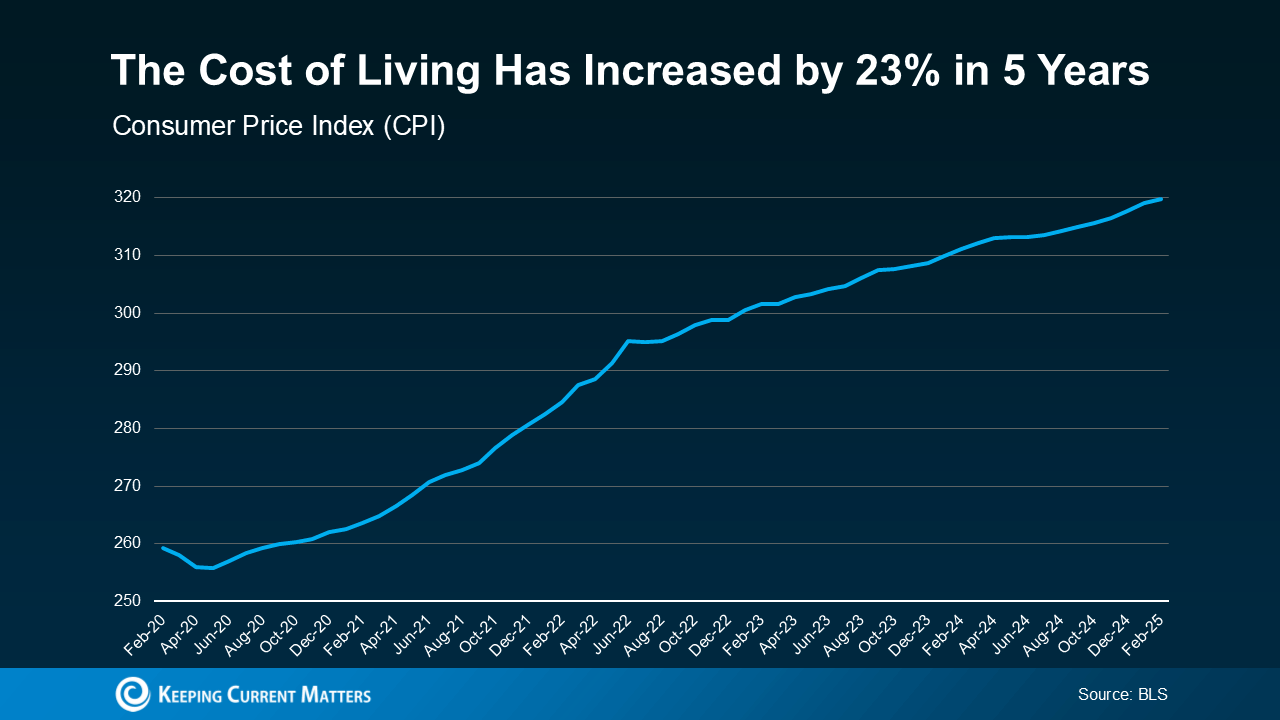

One of the first questions to consider is whether your existing home suits your retirement plans. Over the past five years, the cost of living has increased by 23%, according to the Bureau of Labor Statistics. This rise in expenses can impact your retirement savings and budget. If your current home requires significant maintenance, has high utility costs, or is located in an area with a high cost of living, it may be time to reassess its suitability for your retirement goals.

Exploring Relocation Options

Many retirees find that relocating to an area with a lower cost of living can significantly stretch their retirement dollars. Moving to a region with more affordable housing, utilities, and taxes can free up funds for travel, hobbies, or spending time with family. Additionally, downsizing to a smaller home can reduce maintenance costs and provide a more manageable living space.

Relocation doesn't necessarily mean moving far away. Sometimes, transitioning from an urban setting to a suburban area can offer the benefits of reduced expenses while keeping you close to familiar amenities and loved ones.

Planning for the Future

It's crucial to plan ahead and consider how your living situation will support your retirement lifestyle. Evaluate your home's accessibility, proximity to healthcare facilities, and suitability for aging in place. Consulting with a real estate professional can provide valuable insights into the best options available to meet your retirement needs.

Bottom Line

You've dedicated years to building a future you can enjoy. If your current home no longer supports that vision, it may be time to explore what's next. Whether it's downsizing, relocating closer to family, or finding a community that aligns with your retirement goals, taking proactive steps now can lead to a more fulfilling and financially secure retirement.

Categories

Recent Posts