What Credit Score Do You Really Need To Buy a Home?

If you're considering buying a home, your credit score is likely top of mind. While it’s true that a higher score opens the door to better mortgage terms, it’s a common misconception that only those with excellent credit can qualify.

In reality, homeownership is more accessible than many realize—with multiple loan types designed to fit a variety of financial profiles.

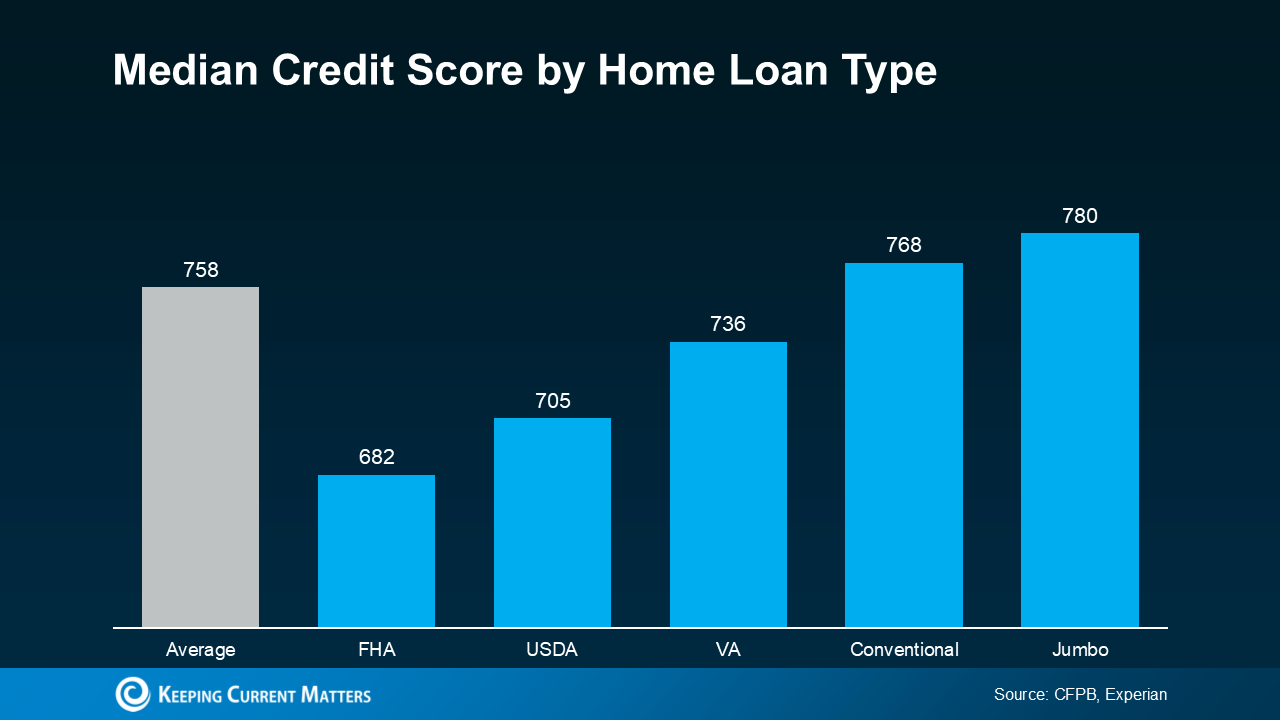

This chart shows the median credit scores by loan type, based on data from CFPB and Experian. While these scores reflect the average borrower profile, many loan programs—especially FHA and USDA—offer more flexible credit requirements. Your unique financial situation may qualify you for different options.

Understanding the Score Ranges

Credit scores typically range from 300 to 850. Here's how lenders generally view them:

-

760–850: Excellent – Best interest rates and terms

-

700–759: Good – Competitive offers

-

660–699: Fair – May require stronger supporting factors

-

620–659: Minimum for many conventional loans

-

Below 620: May still qualify for certain FHA loans

Loan Programs and Minimum Requirements

Different loan types have different minimum credit score requirements:

-

Conventional Loans – Most lenders require 620+, though better rates come at 740+

-

FHA Loans – Designed for first-time buyers, often allow 580+ (with 3.5% down)

-

VA Loans – No official minimum, but most lenders look for 620+

-

USDA Loans – Generally require 640+, and are geared toward rural buyers

Beyond the Score: The Full Financial Picture

Lenders take a holistic approach to approving buyers. Factors beyond credit include:

-

Debt-to-Income Ratio (DTI)

-

Employment Stability and Income

-

Down Payment

-

Cash Reserves

A strong application can offset a lower credit score, especially if other elements are in your favor.

Key Takeaway

You don’t need perfect credit to own a home—but you do need to understand how your full financial picture plays into what you qualify for.

Next Steps

If you're unsure where you stand or haven’t yet connected with a lender, now is the time. Partnering with a knowledgeable mortgage professional—and an experienced real estate agent—can help you understand your options and create a path forward.

Categories

Recent Posts