Are Rising Mortgage Delinquencies a Sign of More Foreclosures Ahead?

At Rhino Realty Pros, led by Rick Cavallaro, we know how important it is for Metro Denver homeowners and buyers to stay informed about housing market trends. One of the most common questions we hear is: “Do rising mortgage delinquencies mean a wave of foreclosures is coming?”The short answer: while delinquencies are inching upward, Metro Denver—and the nation overall—remains in a stable housing position. Here’s what you need to know.

Mortgage Delinquencies Are Rising, But Slowly

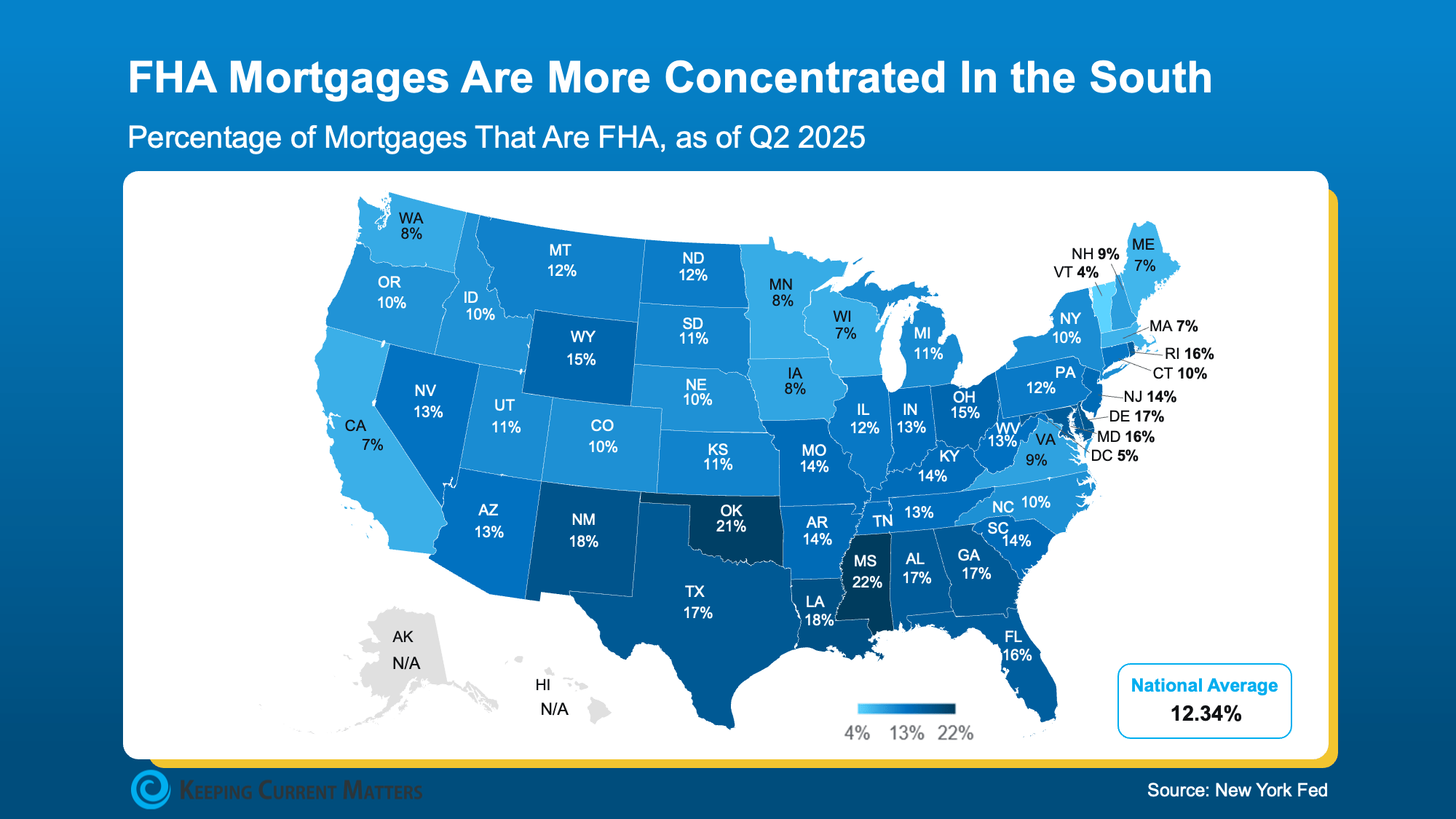

Nationally, the mortgage delinquency rate has ticked up slightly, particularly among government-backed loans such as FHA and VA. These programs are seeing more borrowers fall into 60–90+ day late payments.In Metro Denver, most conventional loan holders are still current, and the increase in delinquencies has been gradual—not alarming.Foreclosures in Metro Denver Remain Low

Despite the slight rise in delinquencies, foreclosure starts remain low both nationally and locally. Less than a quarter of one percent of mortgages are entering foreclosure.For Metro Denver homeowners, a major safety net is home equity. Unlike in 2008, most borrowers today owe less than their homes are worth, which means they can sell or refinance rather than risk foreclosure.Why Equity and Lending Standards Matter

Rick Cavallaro and the team at Rhino Realty Pros emphasize that today’s lending environment is very different from the past housing crash. Stricter underwriting standards and higher home values give Metro Denver homeowners stronger financial footing.Even when households face challenges from higher taxes, insurance, or inflation, equity provides an exit strategy that wasn’t available to many in the last crisis.What to Watch in the Coming Months

While we don’t expect a flood of foreclosures in Metro Denver, here are some areas to watch:- Government-backed loans: FHA and VA borrowers are showing the most stress.

- Cost of living: Rising insurance premiums and property taxes are adding pressure.

- Regional trends: Some neighborhoods may feel more impact than others depending on economic conditions.

The Bottom Line for Metro Denver Homeowners

At Rhino Realty Pros, we believe the data points to a resilient housing market in Metro Denver. Mortgage delinquencies may continue to creep upward, but widespread foreclosures are unlikely. Strong homeowner equity, better lending practices, and support programs all act as buffers against a repeat of 2008.For homeowners, this means peace of mind. For buyers and investors, it suggests that while a few opportunities in distressed inventory may arise, the market overall remains strong.If you’re in Metro Denver and want to better understand how these trends affect your buying or selling plans, Rick Cavallaro and Rhino Realty Pros are here to guide you every step of the way.Categories

Recent Posts

Ditching the Mile High City Affordable Alternatives in Pueblo and Colorado Springs

Denver's Condo Comeback Is New Construction the Key to Affordability for Millennial Buyers?

The $400k Challenge Find a House Near the Denver Light Rail

Stop Renting: 5 Up-and-Coming Metro Denver Neighborhoods Where First-Time Buyers Can Still Win

Answering the 3 Housing Market Questions Everyone in Metro Denver is Asking This Season

How to Find the Best Deal Possible on a Home Right Now in Metro Denver

The Rhino Report: December 2025 Issue

Selling Your Home in Metro Denver? Here Are 2 Key Things Every Homeowner Should Know

The Real Reasons Homeownership Will Be Worth It

Veteran Housing Grants and Assistance Programs in Colorado